Dental Insurance – Arlington Heights, IL

Putting Your Child’s Oral Healthcare Needs First

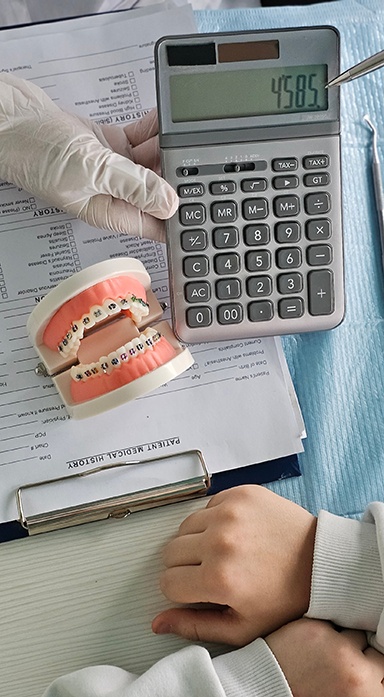

All About Kids Dentistry is an insurance-friendly dental practice that welcomes your dental insurance in Arlington Heights. Although we base our recommendations on your child’s unique needs, not on what is covered by insurance, we also strive to help our patients avoid high out-of-pocket expenses. We happily file claims to improve your chances of maximum reimbursement. If you have questions about how to use your plan when bringing your child in for a visit, call a member of our team today.

How Dental Insurance Works

Traditional dental insurance typically covers preventive and restorative treatment. If your child requires regular dental checkups and cleanings, X-rays, or other similar preventive services, these may be covered at 80-100% by your insurance company.

If your child requires more complex treatment, such as dental fillings, dental crowns, pulp treatment, or tooth extraction, these services may be covered at 50-80%.

Your child’s dental insurance wants to minimize your out-of-pocket expenses, which is why they commit to paying a portion for certain services received. However, the amount they agree to pay ultimately depends on whether you’ve met the annual deductible and how much of the yearly maximum remains available.

Three Important Facts About Dental Insurance

All About Kids Dentistry (AAKD) prides itself on providing the highest-quality, most compassionate, and individualized care for all our patients. For those reasons, and due to the restraints insurance networks enforce by limiting coverage, downgrading procedures to reimburse at lower amounts, and delaying claims processing, all practices that have a direct impact on patient care, AAKD chooses to be out-of-network with all dental benefit plans.

As a courtesy to our patients enrolled in dental insurance plans, we file primary and secondary dental claims with any Preferred Provider Organization (PPO) carrier. However, because we are not in-network providers, insurance companies do not share their allowed fee schedules with us and reimburse at their standard fee, leaving our office to estimate your plan's coverage. Often, when requested, carriers will share their fee schedules with policyholders. If this is possible, we encourage you to do so.

Our office cannot file dental claims with any Health Maintenance Organization (HMO) plans, such as BCBS Community, nor can we file with any state insurance programs, such as Meridian, All Kids, or Medicaid Dental. It is essential that you provide current and accurate insurance information so that we may file your claim correctly. Failure to do so can result in the insurance company denying the claim and requiring you to pay 100% of the treatment costs.

The treatment recommendations of our doctors are based on your child’s dental needs with the objective of achieving the best overall outcome in the least invasive manner. Our recommendations are not based on or influenced by an insurance company representative's opinion. For larger treatment plans requiring multiple visits or General Anesthesia, we can submit a predetermination to your insurer to determine which procedures they will cover and what percentage of our fee will be covered before beginning treatment. Predeterminations can take 2-6 weeks from submission to receipt/processing by the insurer and back at our office.

Some Important Dental Insurance Facts

Fact 1. No dental insurance pays 100% of all costs; insurance is meant to be an aid that offsets some of the cost of dental care. Many consumers think dental insurance pays 100% of all dental fees, but this is not the case. Most plans pay 80-90% of cleanings and 70-80% of treatment, factoring in patient deductibles. Many plans pay less and have many exclusions; very few plans pay more. Coverage amounts are set by your insurance company's "allowed fee" schedule, which is based on the plan negotiated between the employer and the insurance company. The simple rule is that lower-cost insurance plans pay less in benefits and cover fewer procedures.

Fact 2. You may notice that your dental insurer reimburses at a lower rate than the dentist’s actual fee. Frequently, insurance companies will show that their payment was reduced because your dentist’s fee exceeded the UCR (usual, customary, and reasonable) fee used by the insurance company. This gives the impression that any fee above their “allowed fee” is unusual, not customary, and unreasonable for the procedure. This wording is misleading and inaccurate. Insurers set their own “allowed fee” schedules, and they are very slow to update them to account for inflation, wage, and material price increases. Many insurers have gone several years without increasing their allowed fee reimbursement schedules. Yet, these same insurers are quick to raise the premiums they charge you, citing inflation, wage, and raw material price increases. Their wording suggests that your dentist’s fees are unreasonable, rather than disclosing that their allowed fee claim payments have not been adjusted in years and are not current with market rates for dental procedures.

Fact 3. Dental coverage embedded in a Medical plan and High Deductible policies are very costly to you - buyer beware!!! If your dental coverage is embedded within your medical plan or you’ve chosen a high-deductible policy, you will most likely have to pay significant out-of-pocket amounts ($2,000, $3,000, $5,000 or more) to meet your deductible before your dental benefits kick in. These plans trick you with a low monthly premium, but end up being extremely expensive when dental treatment is needed. As the insurance holder, you are responsible for knowing if you have a high deductible or dental embedded in your medical policy.

What is the Difference Between Dental and Medical Insurance?

Using your child’s medical or dental insurance to pay for treatment may leave you slightly confused, especially if you thought they were the same. What makes them different is:

- Medical insurance offers greater coverage for needs required after an illness or accident has occurred. If your child needs to visit the emergency room, be hospitalized, or undergo surgery, insurance will cover a larger portion of the bill than if you take them to see their pediatrician for a wellness check.

- Dental insurance encourages you to take your child to see their dentist for preventive checkups and cleanings, often offering the most significant coverage for these services. This reduces the need for restorative treatment, which requires your insurance to pay more.

In-Network vs. Out-of-Network

All About Kids Dentistry is out-of-network, so we are not contracted with any dental insurance company. This means we base your child’s treatment on what they need, not what their insurance plan will agree to pay for. With this approach, we can take better care of your little one’s oral health, helping them avoid more serious oral infections and injuries in the future.

Although you may want to find a dentist who takes your dental insurance, you’ll find that by choosing our team to take care of your child’s smile, we still find ways to help you save by filing claims and keeping treatment affordable.